My United States of Whatever: Cross-Border Commerce in the Age of Confusion

A Cross Border Report like No Other, Ever.

Earworm alert: Cue angsty guitar riff from Liam Lynch's one-hit wonder, fade into a dystopian pop-up shop where every price tag is handwritten in five currencies, and the cashier is a chatbot named "Todd" who insists on upselling you customs duty insurance. Is better to burn out or fade away.

It’s 2025, your face serum ships from Seoul, your runners/trainers/sneakers from Sydney, and your trust in cross-border delivery from somewhere between purgatory and a DHL warehouse. In many non religions, they are the same thing. In prep for the Ostrich Report, I have been doing some reading. This time a trip to FlavorCloud. FlavorCloud's "State of Cross-Border Consumer Insights 2025" dropped like an Amazon drone into our inbox this week. Well actually Hendrik gave it to me. So here is my view on the chaotic, tariff-choked, zone-restricted world of global ecommerce—V Spot style.

And yes, it’s called My United States of Whatever. Because that’s what cross-border ecommerce looks like today: fragmented, over-legislated)not necessarily a bad thing), algorithmically priced madness where brands want growth but get spreadsheets.

The Exhausting Annual Marvelicious and Superfluous Global Tug-of-War: From Growth Strategy to Survival Mode

Pre 2020, we were the pariahs. Post 2020, we remain the pariahs. However in 2020, cross-border trade was a nice-to-have. By 2025, it’s an existential necessity, to us. Who is “us”. US is a small tribe of people who believe that cross Border trade or international, as the French Canadians call it have long since held a view that CBT will help on your growth journey. An indication of how serious you want to be perceived. So serious, that you send your canary down the mine first (your marketplace manager - who has 60% of the salary of your head of ecommerce and 5% of the budget. AnIT “resource” and an annual battle to prove marketplaces work. Enough of my flapping.

According to FlavorCloud, over 31% of global ecommerce is now cross-border, a number that sounds great until you realize it’s being choked by tariffs like a cargo ship stuck sideways in the Suez Canal. True Story.

Merchants aren’t just optimizing for speed, they’re dodging retaliatory tariffs like it’s a dodgeball game between Biden, Trudeau, and Xi Jinping. Dodge, duck, dip, dive, dodge? New tariffs in 2025? Yep. 25% extra on Canadian and Mexican goods, plus China’s revenge tax plan. And this isn't a Netflix original, it's real life.

Naomi Klein called it 20 years ago in No Logo: global brands, local casualties. Back then, the enemy was sweatshops and street protests. Now it’s Customs & Border Protection and opaque HS code classifications and em, sweatshops and street protests. The circle of life.

Health & Wellness: The New Oil (Palm free mind you so everyone’s a winner, right?)

In this strange, digitized global bazaar, one vertical has emerged as a cross-border juggernaut: Health & Wellness. But try calling someone in the space a Juggernaut. Highly insulting.

+132% growth from Q1 to peak 2024

+201% YoY growth

Supplements, nutraceuticals, and adaptogens are being flung across borders faster than conspiracy theories on TikTok. Why? Because unlike t-shirts, magnesium gummies don’t shrink, and they promise you’ll sleep like a Scandinavian lumberjack.

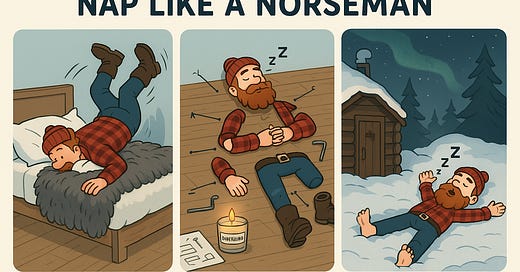

How does a Scandinavian Lumberjack sleep I hear you ask

Ah, the majestic Scandinavian slumberjack. Not to be confused with your average lumberjack , this one chops zzz’s, not trees. Here are three funny ways a Scandinavian slumberjack might catch some Nordic-style shuteye:

1. The Fjord Flop™

He cannonballs into bed like he's diving into a freezing fjord, then immediately enters a deep REM cycle wrapped in six ethically-sourced reindeer pelts. Occasionally murmurs “Uff da” in his sleep as a form of sleep-yodeling.

2. The IKEA Flatpack Nap

He dismantles himself into 14 labeled parts (legs, torso, beard, etc.) and reassembles into a fully horizontal sleeping position using only an Allen key and emotional resilience. Sleeps peacefully next to a scented candle called “Dozzklund.”

3. The Sauna Snooze Shuffle

He warms up in a log sauna at 110°C, then runs barefoot into the snow, does a snow angel, howls at the northern lights, and immediately collapses into a nap so intense it registers on the Richter scale. Wakes up mildly smoked and fully rested.

Check out my bedtime reading - “Nap Like a Norseman.”

Other verticals:

Beauty & Cosmetics: +92% to peak, but -14% under tariff weight.

Apparel: once glorious, now faltering with a YoY decline of -3%.

Consumer Goods: stable at 8% conversion, aka the "rice cake" of ecommerce.

Conversion = Trust x (Landed Costs – Sticker Shock)

Let’s talk conversion. You know, that sacred ecommerce KPI that turns browsers into buyers? It turns out that tariffs drop conversion by 30% when not pre-calculated. Surprise costs are the new villain origin story. Remember the kerfuffle when brands dared showed the tariffs in checkout, the cheek.

ANZ: 20% conversion (legendary)

North America: 18% (credit to Prime PTSD resilience)

LATAM: 5% (blame it on fees, corruption, and weather apps with better UX).

Geography of Spend: Average Order Value by Region

FlavorCloud's AOV breakdown reads like a socioeconomic Tinder profile:

Middle East: $160.86 - rich tastes, big baskets, perfume dreams.

Asia: $128.88 - high interest, lower retention.

Europe: $89.72 - tight wallets, stiff customs officers.

LATAM: $123.47 - potential if you can afford the bribes and bandwidth

Repeat Offenders: Where Loyalty Actually Exists

The holy grail of ecommerce isn’t acquisition, it’s retention. But it is largely a bolt on. The ones who do loyalty well have it in their DNA. They klnow it has to evolve and is more than a subscription model. Because your CAC ain’t paying for itself.

LATAM: 43% repeat purchase rate.

North America: 32% (grudging but faithful).

Asia: 21% (ghosted after one bad delivery experience).

But, like the mythical mountain Lion, is hiding in plain sight, to itself, but not anyone else. Finding them is quite the task. Loyalty though, is hard to earn. Anywhere. It is kept largely for the chosedn few.

B2B: The Forgotten Giant

Let’s be honest, most of the chatter is about DTC brands. But B2B is the $20.4 trillion elephant in the room—5x the size of B2C. Asia-Pacific owns 78% of it. Europe and the U.S.? Still asking their finance teams if they can invoice via PDF. And if you read my work at al, you will have read my papers on the investment of Private Equity into B2B commerce earlier this year. B2B involvement usually signals the beginning of the end though, right?

These guys are now borrowing DTC playbooks: air freight, automated customs clearance, and even SKU-level pricing. They’re doing Shopify, but on forklifts.

Tech-Enabled Trade: Buzzwords That Actually Work

Tech innovation investment has been enormous over the last decade. Trying to move the conversation beyond last mile cost and knowing their market has forced this part of supply chain into an uncomfortable area - post investment blues. Customer acquiring usually still starts at cost, capacity or missed opportunity. Then the tech can shine. But table stakes too, have changed. Let’s run through the greatest hits of modern logistics:

DDP (Delivered Duty Paid): No surprises = fewer cart abandonments.

10-digit HS classification: Finally, AI used for something other than fake Drake tracks.

Localized Market Pricing: The psychological comfort of seeing your own currency + tax.

Dynamic Routing: Like Google Maps but for your serum.

Carrier Consolidation: DHL, FedEx, UPS—one day they’ll just form a band. DF*Ups I think it will be called. That’s for you Hendrik.

What Naomi Klein Would Say

If Naomi Klein were writing No Logo: The Cross-Border Edition, she’d rage against the myth of borderless consumer freedom. A t-shirt on your Instagram feed does not mean access. It means:

An import duty calculated by an algorithm in Toronto. Thanks Tobi.

A VAT pre-payment deducted by a Swedish fintech.Buy Now, Pay Never.

A customs declaration misfiled by a sleepy warehouse in Cleveland.RumpleStealthSkin.

What looked like liberation was actually fragmentation. The neoliberal fantasy of the frictionless market has become a Kafkaesque spreadsheet with drop-down menus for "country of origin" and "harmonized tariff subcode."

What’s Next: Cross Border 2030 (or The 7 Things That Will Definitely Happen Unless They Don’t)

Tariffs Will Stay Petty – Global politics makes them worse, not better.

AI Will Classify Your Socks – And it’ll be right 93% of the time.

APAC & LATAM Will Own the Growth Narrative – Sorry, UK. You had a good run.

Returns Will Become International Diplomacy – Reverse logistics meets NATO.

B2B Brands Will Steal the DTC Playbook – And actually use it to scale.

Localisation > Translation – Nobody trusts checkout that says "Ship via Planet Express or Buy With Prime for that matter."

Your Grandma Will Subscribe to Chinese Probiotic Drops – Cross border is not just for Gen Z.

TL;DR: Borders Are the New Battle Lines of Ecommerce

Cross-border trade is the one-night stand that became a marriage of convenience. It’s messy, emotional, and involves too much paperwork. But with smart tools, decent strategy, and a brutal understanding of regional quirks, brands can survive—and thrive.

The winners? Brands that:

Show the true cost upfront.

Use tech like they mean it.

Know that a Brazilian shopper isn’t just an American with better taste in shoes.

And if that doesn’t work? Well... "this is my United States of Whatever."

Guitar riff out.